A briefing by London Economics reveals that the change to UK student loan repayments being introduced by the Government this year are - surprise, surprise - relatively regressive.

As reported by the Observer:

…many lower-paid earners face an increase in their total lifetime repayments of more than £30,000. Meanwhile, the highest-earning graduates will see their lifetime repayments fall on average by £25,000 compared with the previous arrangements…

Right now the average debt resulting from a graduate’s first degree is around £50,800. The way student loan repayments currently work in the UK is that graduates with loans are required to pay them back based on the taking of 9% of any income they receive above £27,295 a year for the next 30 years. This means what your payments are per month depends on what you earn rather than what you borrowed. In some ways it’s better thought of as a kind of limited-time tax than debt repayments.

What you borrowed just influences how long it’ll take you to pay it back. If you haven’t fully paid it back within 30 years then it’s written off. In reality, most students never pay back the full amount.

Anyway, to borrow from the London Economics report, the changes being made include:

- Reduction in the repayment threshold to £25,000, frozen until 2026-27 uprated with Retail Price Index (RPI) inflation thereafter (instead of (higher) average earnings growth)

- Removal of real interest rates, both during and after study

- Extension of the repayment period by 10 years, to 40 years

Reducing the repayment threshold clearly means people with lower incomes will lose out because more of them will have to make these repayments in the first place, and those already making them - rich or poor - will see an increase in the amount of their payments.

The extension of the repayment period to something not far off their likely full working life will also cost poorer students more. Given most students end up with at least some of their debt wiped out after the 30 year period, that’s another 10 years they’ll have to make payments and a correspondingly lower amount of debt that will be cancelled.

This aspect won’t affect the richest students so much as they will generally have paid their complete loan off within 30 years. Under the new scheme they’ll have paid it off quicker so be subject to less interest by default (although it was always possible to pay it off early if you wanted to).

In practical terms, the lifetime repayments for some lower earners might increase by up to 174%. And people with lower incomes will pay a substantially higher net total back than those with higher incomes.

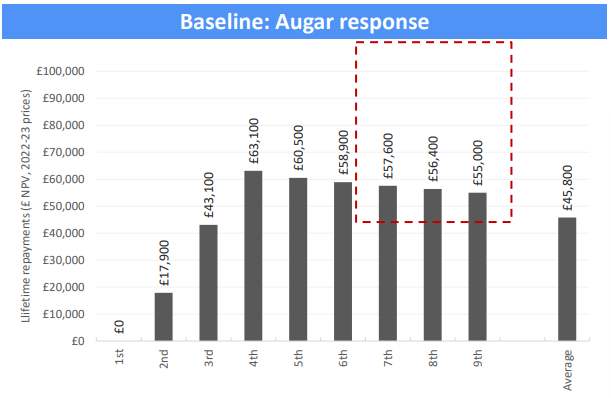

The research forecasts that a graduate earning £37,000 by 2030 would pay back £63,100 over the course of their career, while a graduate earning £70,000 would pay back just £55,000.

Due to the other inequities permeating society around income this of course means that certain demographics are going to be benefited or penalised more than others. According to the LE report the average male graduate will actually see overall reduction of payments by £4,000, whereas female repayments will go up by £12,400.

One of the senior partners at LE, Gavan Conlon, is quoted as saying:

This is effectively a massive subsidy to predominantly white, predominantly male graduates. It’s deeply regressive.

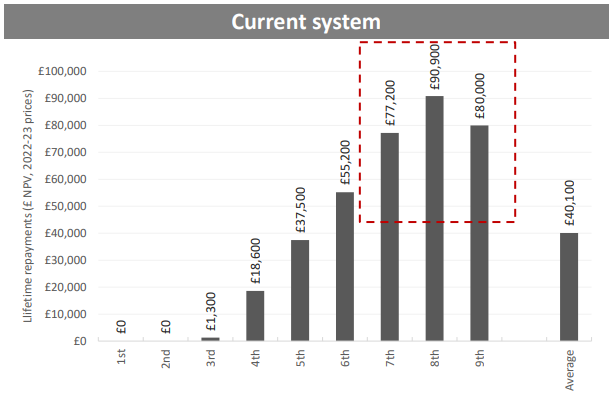

Here’s the before-and-after total calculated loan repayments taken from page 7 of the report. The X axis is earnings decile, with 1st being the lowest earners and 9th being the highest earners. The y axis is total amount repaid.

Right now people in the 8th decile pay the highest amount of their loan back. After the changes it’ll be people in the 4th decile.

These changes are for students with English student loans. Wales will not be making these changes with the Welsh education minister, Jeremy Miles, saying that we:

…certainly shouldn’t be asking teachers, nurses and social workers to pay more, while the very highest earners pay less.

Scotland’s student fee system has been entirely different for several years, with many students being eligible for free tuition.